Nothing For Money

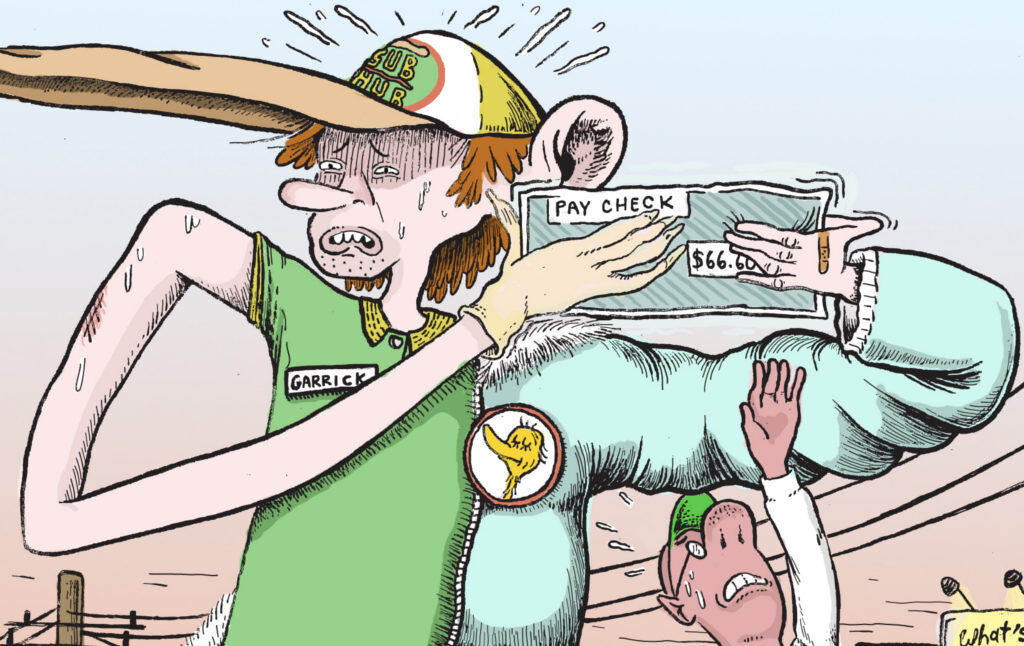

New and creative ways to siphon people’s money away are constantly being innovated…

In consumer finance, there are three kinds of shadiness: fraudulence, dubiousness, and bullshit. First, there are the outright criminal acts, like Wells Fargo opening millions of accounts in people’s name without their permission, or the swindlers who call pretending to be the IRS or tech support or a grandchild and steal their money that way. Since the fraudulent acts are already against the law, the main discussions are about who should be going after those who commit these crimes, and whether that regulator/prosecutor is doing a good enough job.

Then there are the dubious financial products, the ones that aren’t clearly illegal but obviously cause harm to consumers in one way or another. This might be payday loans or car title loans or subprime auto loans generally. It might be check cashing, or debt collection. They’re predatory, but they’re legal. And the finance industry has a ready defense of them prepared, insisting that while these products may be expensive or harmful, people need them. For predatory loans, the borrowers need cash and have no other way of getting credit. For check cashing, people need to turn checks into money and don’t have access to the banking system. (Even for predatory debt collection, the industry will argue that too many restrictions on debt collectors will make it harder for lenders to sell debt and they will have to make credit more expensive on the front end.) Those astronomical prices for the loans or check cashing (and the vicious collection tactics) are just ways of pricing risk and keeping credit available to everyone.

This defense is used for every financial product: people voluntarily use it, therefore they must derive a benefit from it. But by turning to the third category, the “bullshit” products, we can see why the fact that people pay for something is no indication that they actually want or need it. We could grant for the moment that payday and title lenders and check cashers actually do provide people with something of value. (Though this still leaves open questions like: “Why have we built a society where some people have to pay 500% interest on a loan just to be able to pay more money than they can afford for medicine to keep them alive?” and “Why should there exist an industry that makes billions of dollars off the misfortunes of the most desperate and vulnerable people? Couldn’t we just provide them with basic banking services?”) But the existence of a class of “services” I call BFPs (Bullshit Financial Products), which offer no value for money, should make us skeptical of the industry’s arguments.

People pay for BFPs because they think they’re getting something for their money, but actually aren’t. Sometimes people pay for them by accident, never even realizing what they have agreed to. BFPs are insidious. They are a series of schemes for sucking people’s money out of their pockets, and trying to avoid having them notice. What’s more they’re legal, they’re surprisingly common, and people are inventing new BFPs all the time. These products show that a number of exploitative financial “services” offered to poor people are not the “necessary evils” the industry would like us to think they are: they may be evil, but they sure as hell aren’t necessary.

So let’s have a look at how some of them work.

- OVERDRAFT PROTECTION

This might be the mother of all BFPs. Just look at what it’s called: “overdraft protection.” What a great thing, right? Of course I want to be protected from overdrafts! They sound bad!

What is it? It’s a fee you get charged when you don’t have enough money to pay your normal, non-fee expenses. It works like this: say you have $100 in your checking account. You go and buy something that costs $101 with your debit card. Instead of having the transaction declined, your bank will cover that extra $1 and let the transaction go through, but they’ll charge you a $35 fee for the privilege. So you have your $101 item or items, but to get them you had to pay your $100 and now you owe the bank $36. Overdraft protection “protects” you from having your debit card declined when you don’t have any money. So instead of making decisions based on how much money you actually have, you get to be in the dark until later when you notice your account balance has fallen deep into the red.

The bank will tell you this is protecting you from having important transactions declined. But it’s hard to imagine a situation in which you would automatically want the bank to cover you and charge $35 instead of at least having the opportunity to think about it first. Maybe you’d rather put back a few dollars of groceries than pay a $35 fee. Or maybe you’d rather deposit $20 before paying the electric bill instead of paying the fee.

But wait, there’s more. You incur that fee on every transaction that dips you below your account balance. At the end of the day when they process your transactions, your bank is probably stacking the transactions from largest to smallest instead of chronologically. So say you have $100 in your account. You think you have $200 in your account because you recently deposited a $100 check, but that check actually hasn’t cleared yet. So you go about your day. In the morning you get a cup of coffee for $5. You get a $10 arepa for lunch and spend another $5 on tea and a cookie in the afternoon. Then after work you go to the grocery store and get $90 of groceries for the next couple weeks.

If your bank processed your transactions chronologically, you would only get charged an overdraft fee on your groceries—that was the only time you spent more money than you had in your account. So you spent $110 throughout the day with $100 in your account, the bank spotted you that $10 that you thought you had to begin with, and now you owe them $45. But your bank probably didn’t do that. Instead they probably stacked them, meaning that first they deducted the $90 for groceries, then the $10 for the arepa, then the $5 for coffee and $5 for cookie and tea. They still only spotted you $10, but they did it for two $5 transactions and therefore they’ll charge you two fees. So now, because they stacked, instead of owing the bank $45 you owe them $80 ($10 extra plus $35 fee * 2). Like magic. Now imagine that again but with an actual normal number of transactions in a day. You can end up owing hundreds of dollars in fees just because you didn’t have enough money to begin with.

Not only is this practice extremely slimy, it’s also extremely common and extremely profitable. In the first three quarters of 2016, around 600 banks surveyed by the U.S. Public Interest Research Group took in $8.4 billion in overdraft fees. That’s $17.76 in fees per banking customer (not just the customers who got charged fees) in eight months. In larger banks (with more than $1 billion in assets) overdraft fees accounted for 8.1% of their net income in that time period. Think about that! Given all the myriad ways that these banks make money—including lending people money—this one completely useless fee accounted for almost 10% of the money they made. In 2015, Bank of America, Wells Fargo, and JP Morgan Chase reaped a combined $5.4 billion in overdraft fees—$5.4 billion just from fees charged to people because those people didn’t have enough money.

Starting in 2009, at least some banks were required to get at least some customers to affirmatively agree to overdraft protection before they could be charged fees. But of course given what a money maker these fees are, major banks spend a lot of time and money trying to figure out how they can get as many customers as possible to “agree” to overdraft protection. In one notable example, TCF Bank would put its overdraft consent forms in the middle of a stack of forms customers were required to sign in order to open a new account. For existing customers, TCF would simply call and ask if they wanted their account to “continue to work as it does today?” If the (probably baffled) customer said yes, TCF took that as consent for overdraft protection. (If these practices weren’t egregious enough, TCF’s CEO literally named his yacht Overdraft. Hah. The CFPB filed suit last year.)

Here’s the thing: I have paid overdraft fees. At the time I didn’t know it was an optional thing—I thought it was just a fact of life that if I accidentally spent more than I had using my debit card it would cost me much more money. Since I learned about overdraft protection I have switched banks twice: once to a national bank and once to a regional bank. Each time I learned some months after the fact, when it occurred to me to check, that I had “agreed” to overdraft protection when I opened my accounts. This particular BFP is probably the most ubiquitous—you will find it anywhere from the largest national banks to your friendly community credit union. Even if you’re careful and you know how it works and you’re on the lookout for it you can still find yourself having “agreed” to it. And then it lies in wait until the very moment when you are most vulnerable, waiting to charge you money for nothing. (By the way, I would really love to hear from anyone who has had a positive experience with overdraft protection. If you exist, write in and let us know about an instance when you were glad to pay your overdraft fee in order to have your transaction processed on the spot. What was the transaction? Why was it worth the extra $35 or whatever the fee amount was? Why was that better than using a credit card if you had access to one?)

- STUDENT LOAN ASSISTANCE

Here are some true and stupidly inconsistent facts: (1) The federal government considers federal student loan repayment options to be easy to figure out, and thinks students shouldn’t need help determining their options and filling out the right forms. (2) Also, federal student loan repayment is extremely complicated, involves dozens of options, conditions, and restrictions depending on when you got your loans, what type of loans they are, what your current repayment status is, etc. (3) In addition to all that, the companies in charge of servicing your student loans, to whom you might reasonably turn for help figuring out your repayment options, will openly admit that you should not expect them to protect your interests.

What to do? Where to turn? I don’t know. Call your congressperson. (If you’re really having trouble, call your area legal aid. Legal aid offices are quickly building a lot of expertise in student loans. Don’t think too hard about why attorneys who can only help people with little or no money have to be experts in people paying the federal government for receiving an education.) Here’s what not to do: respond to any ads or mailers you get about student loan assistance.

I get these things in the mail all the time. Here are some common features. They’ll come in some sort of official-looking tear-the-edges-and-unfold format to make them seem like a government document. They’ll have boxes on them and probably some numbers like “Customer Number” or “Benefit ID #” (these are meaningless). They will try to make you feel like something is urgent or time sensitive BY USING ALL CAPS and printing the word NOTICE and/or EFFECTIVE IMMEDIATELY. They may also give you a deadline for responding.

The actual content will vary. Some of the less egregiously false ones will say something like “student loan consolidation could lower your student loan payments” (this is true—with about a billion caveats). The really bad ones will say completely untrue things, e.g. that there’s a “new law” and you’re eligible for benefits or that you can have your loans completely forgiven. They used to reference Obama sometimes. I haven’t seen one that references Trump yet, but it’s probably out there.

What will these companies actually do for you? Usually the same thing they do for everyone else. You will call them and they will gather all of your information and then they will tell you that you should consolidate your loans and apply for income-based repayment. Sometimes that’s true! If you’re in default and you need to get out of default immediately, or if you have certain kinds of loans that don’t qualify for income-based repayment, then sometimes consolidation is a good idea and the right way to become eligible for payments based on your income. But sometimes it’s not true! Maybe you’re not in default and you could get on income-based repayment immediately. Maybe you’re already on income-based repayment. Maybe you’re in default but it would be better for you to rehabilitate your loans than to consolidate them. Maybe you really are eligible for loan forgiveness. (You’re almost definitely not eligible for loan forgiveness, but it is possible.) These are usually not the sort of details that these companies concern themselves with.

So they’ll promise to help you by consolidating your loan and getting you on a lower payment plan. OK, fine, how much does it cost? IT COSTS SO MUCH. Many of these companies will charge an upfront fee, usually several hundred dollars. Then they will continue to charge you fees every time you make a student loan payment forever. They may not even tell you these are fees. One company was telling people that their monthly payments were $39 when their actual monthly payments were $0, plus a $39 per payment fee! If you have your student loans for 20 years (the time period at the end of which, if your income has been sufficiently low the whole time, you can have your loans forgiven), that fee ends up being $9,360!

And here’s the rub. Once you have some idea of what you need to do with your student loans, it actually is pretty easy to do it yourself. Sure, it can be hard to figure out what the right arrangement is. (Remember, though, these companies don’t really do that anyway. They just do the same thing for everyone.) But once you know, for example, that you want to consolidate your loans then try to get on an income-based plan, that’s pretty easy to do! It’s like two forms. You can get them online and fill them out yourself over the course of about 10 minutes. They don’t require any special expertise at all. They are designed so that borrowers can fill them out on their own.

So the student loan assistance companies will literally charge you many thousands of dollars to do something that: a) is not even necessarily the right thing for you; and b) is extremely easy and fast to do yourself if it is the right thing for you.

It’s definitely true that dealing with student loans is hard. A lot of people need help. You can’t always just do it on your own. But it’s also true that these companies don’t really help. They take advantage of confusion and desperation to squeeze thousands of dollars out of struggling people. Be wary!

- PAYMENT ACCELERATORS

The way most loans work is that interest charges are assessed over time based on whatever your remaining principal balance is. The principal is the amount you borrowed in the first place. So if you go get a car loan for $30,000 at 5% annual interest, your principal balance is $30k. Your monthly payment for this loan is probably around $566. But of course your first payment doesn’t all go to that $30k, some of it goes to interest. In this case, one month’s interest on $30k at 5% is $125. So when you make that first payment, you pay $125 to interest and the remaining $441 to principal. Then the next month’s interest is calculated based on your new principal balance, which is a little less than it was before, so the next month’s payment goes a little bit less to interest and a little bit more to principal. And so on. This is a very simple description of how scheduling loan payments works. It’s called amortization.

Eventually your last payment will cover whatever tiny bit of interest has accrued on your now tiny principal balance, plus that remaining principal balance. Then you will have paid off the loan, plus interest. In this example, you will have paid about $3,968 in interest. Meaning you paid $33,968 for a loan of $30,000. Again, basics of lending.

Another basic of lending: if you pay more than your required payments, you will a) pay your loan off faster and b) pay less money overall in interest. Let’s see how that works. If you pay an extra $500 in the first month of your car loan above, you’ll pay the loan off a month earlier and your total interest payments will be around $3,830. Catch that? That means you would only pay $33,830 for your $30,000 loan. You can save $138 over the course of five years just by paying $500 extra at the beginning instead of spreading it over time. You have to pay the $500 eventually no matter what—the savings comes from paying it at the beginning. If you put in an extra $500 every year, your total interest paid would drop to around $3,594. So, again, paying more money toward your loan than your normal monthly payment requires means you pay less money overall. Got it?

With that background we can talk about payment accelerators. These are companies that offer to help you pay more money toward your loans earlier on. And, they promise, they will thereby help you save money on interest and pay your loans off faster. And that’s true. As we’ve seen above, if you pay more money earlier on, you pay less interest overall.

They usually structure their programs by your paydays. For example, they’ll tell you: “Wouldn’t it be easier if instead of paying your loan monthly, your loan payments matched up to your paydays?” Most people get paid every two weeks. So, they say, they will withdraw half of your monthly payment every two weeks matching your payday, and then they’ll send it to your lender for you. And since you get 26 paychecks every year but only need to make 12 monthly payments (i.e. 24 half-monthly payments), you end up paying a whole extra monthly payment toward your loan each year. That’s how they help you pay early and save interest. But the questions, as always, are what are they charging you for this “help” and do you really need it?

First, they generally charge you a lot. The companies that do this for your mortgage will sometimes charge you a full mortgage payment up to $1,000 to start the program, and then a fee of $5 or so every time they withdraw a payment from you, which is usually every two weeks. If you used a payment accelerator for your whole 30-year mortgage, you’d pay almost $5,000. There are also companies that do this mainly with auto loans. They charge a little less, but it’s still a lot. Most of them will charge you $399 at the beginning and then $2-3 per withdrawal, again usually every two weeks. So for a five-year loan, even if you pay it off six months early, you’re still looking at almost $700 in fees.

And no, you really don’t need their help or to pay their fees. You can 100% do this yourself for free. In fact, your lender might even have their own version of this program that you can enroll in directly. Or you can just set up automatic payments from your bank. Make them match your paydays if you want, especially if you’re the sort of person (like me) who needs automation to impose discipline on their budget, lest you see some cash in your bank account and end up with novelty lamps and military dog portraits. Or, if you’re more disciplined you can just send a check for whatever extra amount you can afford at the end of the year. You will still save money on interest and you will do it without paying hundreds or thousands of dollars in fees to some random company for the privilege. (And you can save even more money by sending those hundreds or thousands of dollars in fees to your lender instead.)

The myth told about markets is that people always buy products because those products provide some kind of value. That’s one defense of payday lending: sure, it might charge poor people exorbitant interest rates and get them caught in never-ending debt traps, but it’s offering a service that those people clearly want and need. (Though again, they only need this because we live in a hideously unequal society.) For some dubious financial products, one can argue that people are better off with them than without them.

But BFPs show that some “products” are really nothing more than legalized trickery. They exist to take advantage of people’s confusion. In some cases, where notices are designed to look like government documents, companies intentionally stoke that confusion. With a BFP, you’re paying for something that either (1) does you no good or (2) you could easily do yourself, if you weren’t being bamboozled into thinking you were being offered a real service. The BFPs are just a way to siphon off people’s limited wealth by exploiting their vulnerability. But it makes sense that they exist. There’s a hell of a lot of money in overdraft fees.

If you appreciate our work, please consider making a donation or purchasing a subscription. Current Affairs is not for profit and carries no outside advertising. We are an independent media institution funded entirely by subscribers and small donors, and we depend on you in order to continue to produce high-quality work.